The cheap car insurance online blog 5750

The Only Guide for Compare Car Insurance Quotes: Get Personalized Rates (2022)

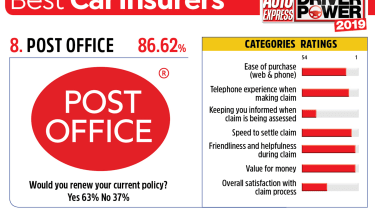

Its insurance products are available in 43 states in the U (prices).S., Canada, Ireland, and the United Kingdom, and can only be purchased through an independent agent. $1,325 Travelers has a somewhat greater yearly premium rate for complete protection than Erie Insurance coverage and USAA, however it's still low compared to the remainder of the industry.

It has common discount rates that you see with other insurance companies, however a few stick out. For instance, Travelers uses a discount rate for just owning or renting a hybrid or electrical vehicle. Its multi-policy discount rates lets you conserve approximately 10%, quickly making it a budget-friendly one-stop-shop for automobile, home, and life insurance.

Auto-Owners Established over 100 years earlier, Auto-Owners is a Michigan-based mutual insurance coverage business that offers automobile, home, and life insurance. It provides insurance in 26 states to nearly 3 million insurance policy holders. You can just purchase Auto-Owners insurance coverage from among its 48,000 licensed independent agents.$1,351Auto-Owners has some of the most affordable rates in the market.

The business declares you could save up to 20%, and even more when discount rates are combined. The discount rates that Auto-Owners offers for insurance policy holders range from discounts for students and security features to discount rates for paying your premium on time and completely. On top of that, it has the highest ranking in claims complete satisfaction, according to J.D.

There are some discounts that all of them use, like bundling or commitment discounts, however there are some that might be special to a particular business. So when you're shopping, you wish to make certain you're being proactive and inquiring about all the discounts you receive. "Discount rates are big, but consumers need to ask about them," says Adams.

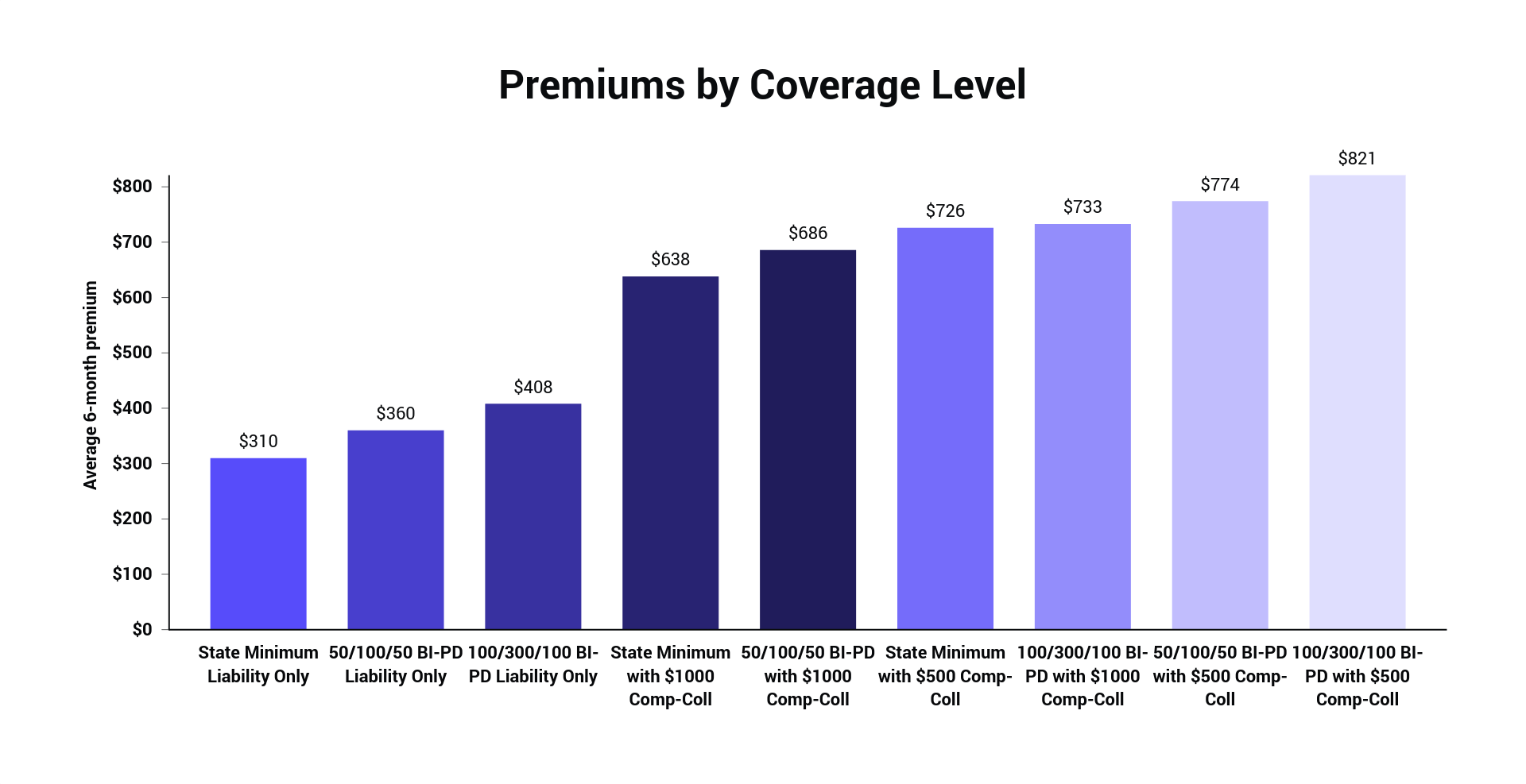

3. Know When to Cut Protection, Having adequate auto coverage is crucial, but there can be a fine line between too little and excessive. You must never ever choose less protection just for the sake of more affordable insurance. Often, it makes sense to drop particular types of coverage, like collision and comprehensive insurance coverage, if your cars and truck is older and has a low market price.

Cheapest Cars To Insure - Progressive for Dummies

Build Your Credit, Your credit score can play a role in your vehicle insurance coverage premiums, depending on where you live. Some states, like California, Hawaii, Michigan, and Massachusetts, don't enable insurance coverage companies to take credit ratings into consideration when setting rates.

If it's on the lower end of the spectrum, you can always enhance your credit report. 5. Keep a Clean Driving Record Insurance companies prefer to guarantee safe motorists who do not have a lengthy history of cars and truck accidents or tickets, due to the fact that they're less most likely to sue. If your threat for accidents is low, your rates are most likely to remain low, too.

One of the very best methods you can save money on automobile insurance coverage is by asking your insurer about discount rates (accident). Numerous automobile insurance companies use discounts for vehicle safety functions or bundling two or more types of insurance coverage. Keeping a clean driving record also works to your benefit because insurance providers will see you as less of a danger on the roadway.

Insurers reason that the less amount of time you invest driving, the less most likely it is that you'll enter into a mishap and sue. auto. What is the cheapest kind of car insurance? The minimum coverage required in your state is the least expensive type of car insurance you can get.

Some states need additional protection on top of liability insurance coverage, like uninsured and underinsured vehicle driver protection or individual injury protection (PIP). Specialists advise getting extra coverage, like thorough and crash, along with liability insurance coverage to ensure you and your vehicle are secured.

Looking for the cheapest pre-owned cars and truck to insure? As it turns out, there might not be one single finest choice for all drivers.

Guests are less most likely to be seriously injured after a crash, which implies lower medical bills. The general crash safety score of a car will likewise influence annual premiums. Two automobiles might have the same security functions, but one of them might have a more secure building and construction in general, for instance. Anti-theft features can reduce the possibility that your vehicle is taken and increase the probability that your automobile is recovered if it is stolen.

Getting The Cheapest Car Insurance Companies Of April 2022 - Time To Work

The more expensive the automobile, the greater the expense of insurance coverage. Add-on functions such as high-end accessories increase the value of the lorry and also make it more costly to repair or replace if taken. Vehicle insurance coverage rates are higher for cars and trucks that have all the bells and whistles. Sports cars and trucks, high-end luxury designs, and electric lorries are more pricey cars to insure, as they have more special elements and cost more to repair.

In general, an automobile that is more costly to repair will be more expensive to insure (auto insurance). Cars and trucks that utilize basic parts are more affordable to guarantee, whereas automobiles that use especially old, rare, and hard-to-find parts will cost more to guarantee. In basic, when trying to find the most affordable secondhand cars and truck to guarantee, look for vehicles around 5 to ten model years old that are basic, reliable models without additional devices.

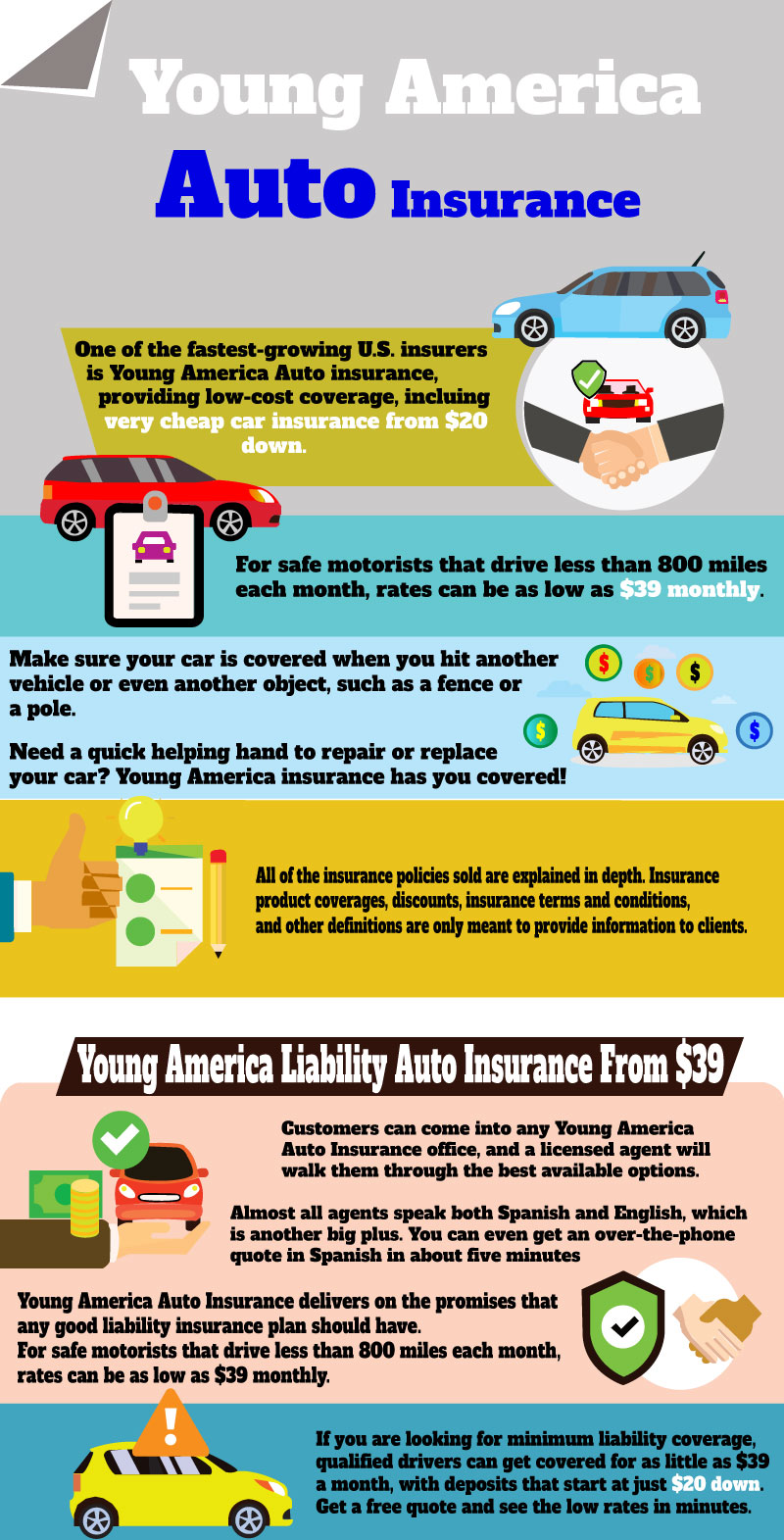

The most inexpensive option is to get your state's minimum bodily injury and property damage liability coverage. If you secure a loan to buy a used automobile, you will probably be required to have collision and thorough protection depending on the worth of the loan and age of the automobile.

If you pay 10 percent of your cars and truck's worth for thorough and crash protection, it may not be worth it. As an example, let's state you pay $1,000 for car insurance and $700 of that is for extensive and accident coverage. If your automobile deserves $5,000, you're paying more than 10 percent of its worth for extensive and collision.

Of course, you'll require to cover damage to your cars and truck in mishaps you cause. Be sure you can handle this risk before dropping complete protection. Where To Start: Models With Low Premium Rates While there may not be one model that is always the most inexpensive used automobile to guarantee, there are several models that satisfy numerous of the criteria mentioned above and are excellent automobiles to search for when beginning your search.

Prior to you buy an utilized automobile, you might also think about having the car checked. Any reputable dealer will enable you to do this. Be sure to consider upkeep costs when selecting an utilized automobile. Even if one vehicle has a more affordable monthly insurance coverage premium, it might cost you more down the roadway if it regularly requires maintenance.

Tips For Reducing Vehicle Insurance coverage Premiums In addition to selecting the best vehicle, there are other ways that drivers can reduce their vehicle insurance premiums. The very best way to find the most affordable rate readily available to you is to look around and compare options from multiple vehicle insurance suppliers (cheaper auto insurance). If you currently have another type of insurance coverage, such as property owners insurance, consider guaranteeing your automobile with the exact same business.

The 10-Minute Rule for Direct Auto Insurance

Consider looking for insurance companies that use usage-based protection alternatives. If you are a safe chauffeur and don't frequently drive late in the evening or on weekends, you may have the ability to save big this method. automobile. Numerous service providers have mobile apps that track your driving habits to minimize premiums. Another way to decrease your premiums is to increase your deductible.

Our Recommendations For Used Cars And Truck Insurance coverage Once it comes time to buy insurance for your used cars and truck, it may not necessarily be the very best concept to opt for the lowest-priced alternative. Be sure that you stabilize expense with reliability and quality claims servicing. 2 suppliers that we recommend for motorists searching for inexpensive, top quality vehicle insurance coverage are Geico and USAA.

Discovering a trusted provider is necessary, however without a doubt the finest method to find the most affordable price is to compare several cars and truck insurance coverage prices estimate. Geico is one of the biggest insurance companies in the United States. In 2021, the insurance provider edited $37. 4 billion in premiums. There is a factor Geico is so popular: it offers low insurance costs for high-level coverage.

The app tracks sidetracked driving, tough braking, and driving time to offer policy reductions. However, it is only available in choose states. We ranked Geico 4. 6 out of 5. 0 stars and called it the Best General company since of its high levels of customer satisfaction, complete protection choices, and strong industry track record.

Method In an effort to offer precise and unbiased information to consumers, our specialist review group gathers data from lots of automobile insurance suppliers to create rankings of the finest insurance companies - vans. > What Is The Most Affordable Car Insurance Coverage in Florida for 2022?

To discover the very best cheap car insurance options it helps to understand how vehicle coverage works. An automobile insurance coverage includes six basic types of protection: Liability Coverage: If you cause a wreck, this part of your auto policy pays to fix the damage you caused both home damage and bodily injury to another person (vehicle insurance).

Some Known Questions About Cheap Car Insurance Online - Way.

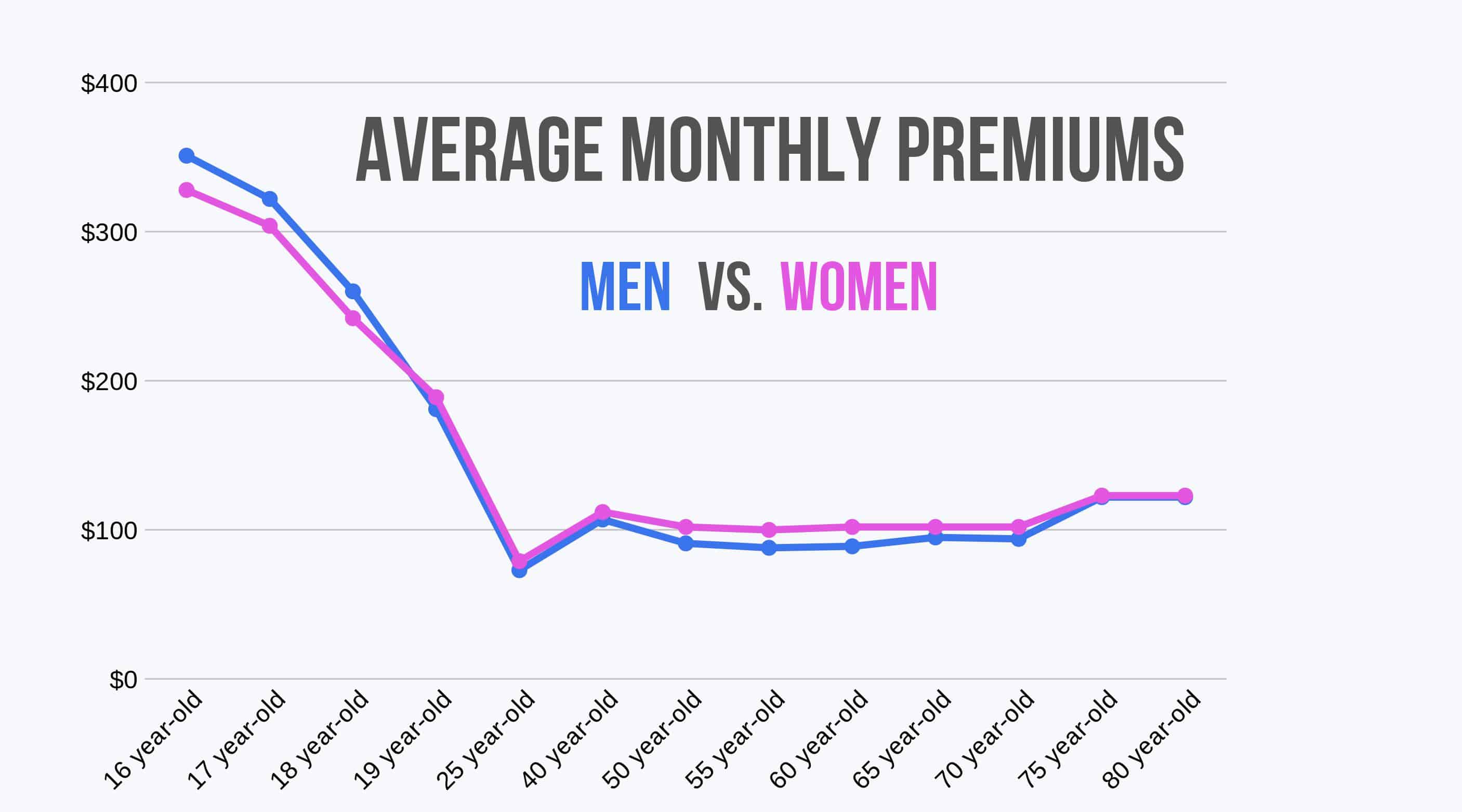

These cover most of the situations you might get in as a driver and auto owner. risks. Along with your driving record, these factors affect the cost of your coverage: Credit rating There is a connection in between lower credit history and greater circumstances of claims. Age Statistics reveal that the youngest and oldest chauffeurs are involved in more wrecks than other chauffeurs.

Telematics Insurers collect real information about your driving routines to determine your threat of having a wreck. Cars And Truck Make and Model Some cars and trucks cost more to guarantee than others since they have higher repair expenses or tend to cause more damage in collisions - vehicle insurance. Automobile Age Given that newer cars and trucks would cost more to replace, policies for newer cars tend to cost more.

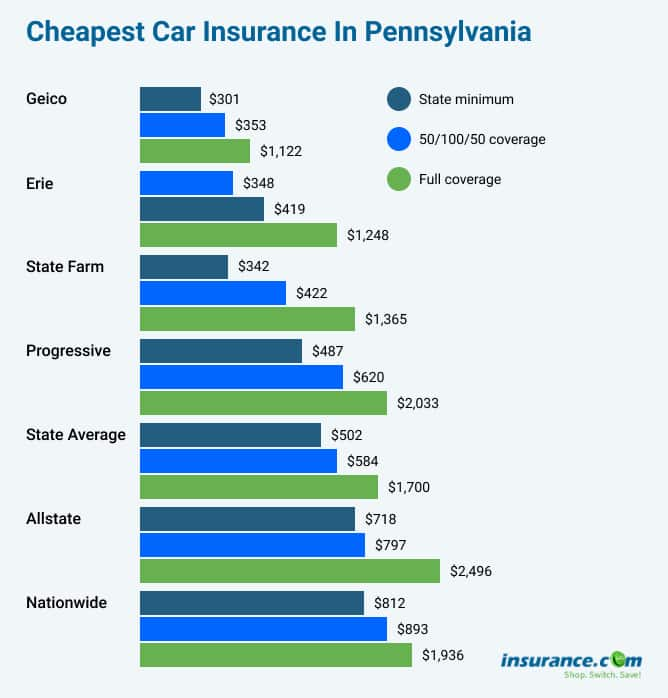

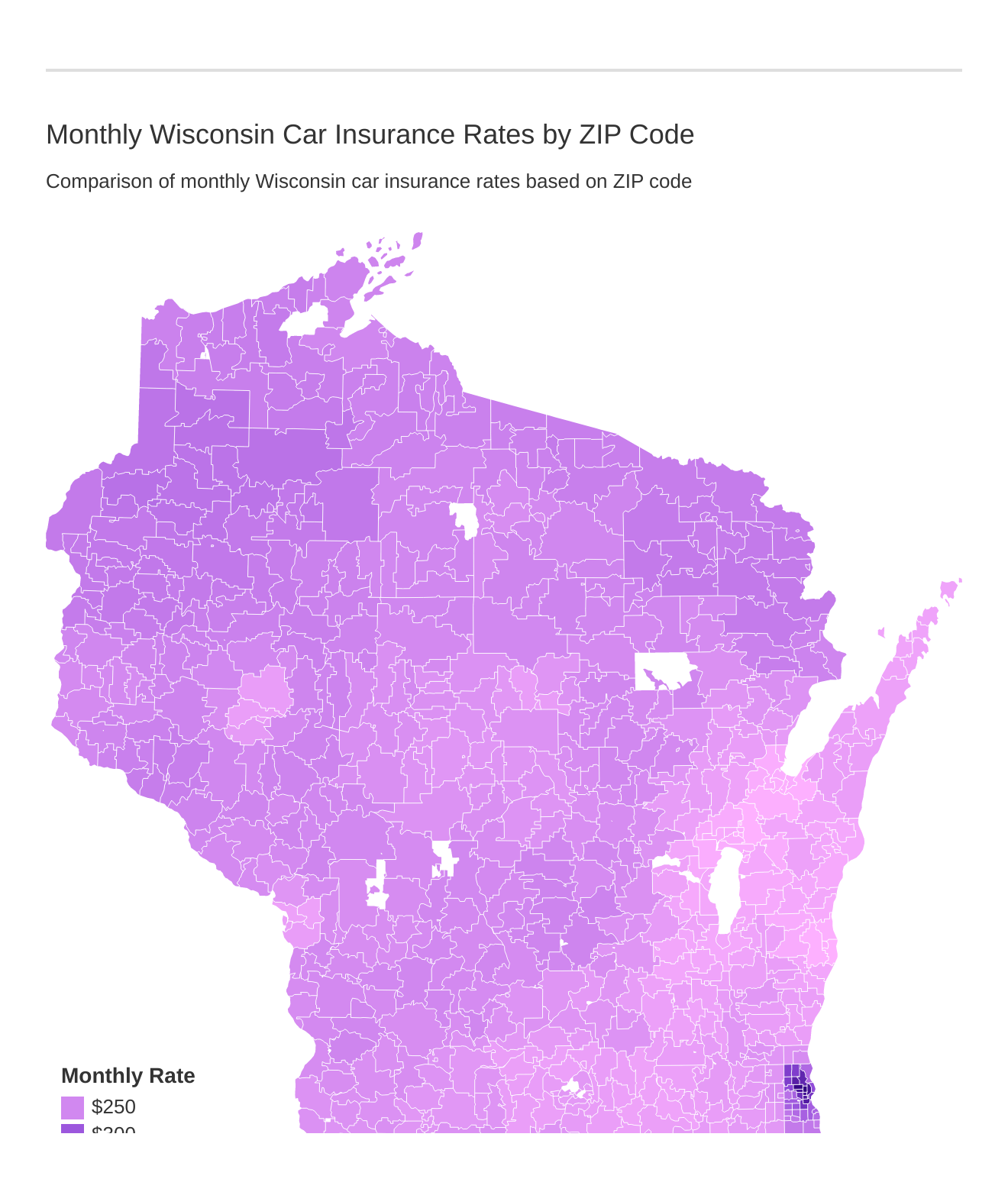

It's based on the other underwriting elements we have actually currently gone over. Finest Low-cost Cars And Truck Insurance Coverage FAQs Who has the cheapest cars and truck insurance coverage? Based on our analysis, Geico is the insurance provider using the most affordable rates. Do car insurance coverage rates vary from state to state? Yes. With some business they differ extensively.

[money-faqs-item concern="How does my driving record affect my automobile insurance coverage rate?"] Mishaps cost insurer cash. cars. Somebody with a tidy driving record is statistically less most likely to have a wreck and can get lower premiums. For how long do negative marks remain on my driving record? In most states, after 3 to four years, the impacts of the unfavorable marks on your driving record will go away.

To find the finest low-cost car insurance coverage options it assists to understand how auto coverage works. A car insurance coverage policy consists of six standard types of protection: Liability Coverage: If you trigger a wreck, this part of your automobile policy pays to repair the damage you caused both residential or commercial property damage and bodily injury to somebody else - car insured.

These cover most of the situations you might get in as a motorist and vehicle owner. In addition to your driving record, these elements impact the expense of your protection: Credit report There is a connection in between lower credit report and higher instances of claims. Age Statistics show that the youngest and earliest drivers are included in more wrecks than other motorists.

Telematics Insurers collect real information about your driving habits to measure your threat of having a wreck. Cars And Truck Make and Model Some cars and trucks cost more to guarantee than others due to the fact that they have greater repair costs or tend to cause more damage in crashes. Automobile Age Because newer cars would cost more to replace, policies for newer automobiles tend to cost more.

The Of 10 Cheapest Cars And Suvs To Insure - Aarp

It's based on the other underwriting factors we have actually already talked about. Finest Cheap Vehicle Insurance Coverage Frequently Asked Questions Who has the cheapest vehicle insurance? Based upon our analysis, Geico is the insurer offering the least expensive rates. Do car insurance rates vary from state to state? Yes. With some business they vary widely.

https://www.youtube.com/embed/ljHEccYhbcI

[money-faqs-item concern="How does my driving record affect my auto insurance rate?"] Mishaps cost insurance business cash. Someone with a clean driving record is statistically less most likely to have a wreck and can get lower premiums. For for how long do negative marks stay on my driving record? In many states, after 3 to 4 years, the results of the negative marks on your driving record will go away.

The Ultimate Guide To Minimum Insurance Requirements - Wisconsin Department Of ...

You must also detail anyone that sometimes drives your car (car). While the policy just requires you to detail "normal" drivers, insurance providers typically translate this term generally, as well as some require that you list any person that might utilize your car. Normally, motorists that have their own vehicle insurance plan can be detailed on your plan as "deferred drivers" at no service charge.

You can usually "leave out" any type of home participant that does not drive your cars and truck, but in order to do so, you must send an "exemption type" to your insurer. credit score. Vehicle drivers who just have a Learner's Authorization are not needed to be detailed on your policy until they are totally accredited.

The majority of states require that you lug auto responsibility insurance in particular minimal amounts. If you are at fault in a mishap, the law calls for that you pay the problems suffered by the individual who is not at fault. These can consist of building damage, which is the price to fix or replace any home that you have actually harmed. risks.

No-fault programs are developed to reduce the price of auto insurance policy by reducing claims as well as litigation. Regarding half of the states have enacted some kind of no-fault or auto insurance coverage reform regulations - cheaper cars. The regulations bordering no-fault insurance policy differ extensively, so you need to consult your insurance commissioner's workplace or an insurance coverage representative for needs in your state.

An individual who is using your cars and truck, pickup, or van with your consent will additionally be covered. At the time the policy is released, you will certainly select the restrictions of liability that you want. The limits that you choose are one of the most that we will certainly pay in the event of a loss. vehicle insurance.

More About Full Coverage Vs. Liability Auto Insurance

It also covers persons that are occupying an insured automobile. At the time the policy is issued, you will pick a protection limitation. The limits that you choose are the most that will certainly be spent for each person about a solitary crash. Underinsured Motorist Protection Although responsibility coverage is advisable and also frequently required, there are numerous irresponsible chauffeurs who do not acquire insurance.

However, if you acquire without insurance driver insurance coverage, your insurer will pay you for the building damage and also bodily injury. It will cover you, member of the family, and any person else occupying an insured auto. The limits for this protection are usually the very same restrictions that you chosen for liability, although you can choose reduced limits.

In some states, underinsured motorist protection is consisted of in your without insurance motorist insurance coverage - insurance. In various other states, you can buy underinsured driver insurance coverage, which covers your excess losses approximately the limitation stated in the policy. Comprehensive as well as Crash If you have comprehensive and also collision insurance policy, your insurer will certainly spend for damages to an insured automobile, despite mistake.

What Is Responsibility Vehicle Insurance Coverage Protection? Put merely, obligation auto insurance pays for injuries and/or problems that you cause to a person else in an accident (business insurance).

Of program, we suggest that you bring a lot a lot more obligation automobile insurance than the minimum. Or else, if the injuries and problems are extreme, you might finish up paying for them out of your own pocket. cheap insurance.One of our representatives will more than happy to advise the best amount of auto obligation insurance coverage for you.

Indicators on Liability Car Insurance Definition - Investopedia You Need To Know

However, if you have a current vehicle insurance policy, your rental automobile could already be covered. There are even some bank card that will certainly cover your rental auto in situation of a crash. Prior to you rent your next lorry, get in touch with your insurance coverage agency or credit score card business as well as find you've currently got rental cars and truck insurance coverage. insurance.

What is the difference in between detailed automobile insurance and crash insurance? Accident insurance coverage is specified as losses you sustain when your vehicle clashes with one more car or things. insurance companies. As an example, if you struck an auto in a car park, the damages to your automobile will be paid under your collision protection.

Can a person else drive my auto under my insurance? Many of the time when you knowingly finance your automobile to a good friend or an associate, they will be covered under your auto insurance coverage plan.

Vehicle proprietors in Colorado are required to lug obligation insurance. Obligation insurance coverage covers physical injury to an additional person or property damage to one more's lorry or home when the insured is at fault for a mishap. The adhering to minimum protections are called for by the state, although greater coverages may be purchased: $25,000 for bodily injury or death to any someone in a mishap; $50,000 for physical injury or death to all individuals in any one mishap; and also $15,000 for building damages in any kind of one mishap.

The Insurance policy Commissioner need to ensure that the individual will have the ability to pay the minimal coverages needed by the state - accident. For additional information on selfinsurance, contact the state's Division of Insurance policy within the Department of Regulatory Agencies (DORA).

The The Role Of Insurance In A Car Accident Case - Nolo PDFs

It is possible to purchase even more insurance coverage protection than the minimal degree of protection needed. Obligation insurance protection protects you only if you are responsible for a crash and also spends for the injuries to others or damages to their property. It does not supply coverage for you, your travelers that are your resident loved ones, or your building - insure.

What other kinds of protection can I buy? Chauffeurs who wish to safeguard their automobiles versus physical damages can need to buy: This coverage is for damages to your vehicle arising from a crash, no matter that is at mistake. car insured. It offers repair of the damage to your lorry or a financial settlement to compensate you for your loss.

It likewise pays for treating injuries resulting from being struck as a pedestrian by an electric motor lorry. Your automobile insurance deductible is the quantity of cash you need to pay out-of-pocket prior to your insurance policy compensates you. vehicle insurance.

You have a Subaru Outback that has Collision Insurance coverage with a $1,000 insurance deductible. You back side an additional driver, as well as your Subaru is harmed. You take it to the body store and the overall cost to repair all the damages is $6,500. In this scenario, you would pay the body store $1,000.

When you have satisfied your $1,000 deductible the insurance provider will certainly pay the remaining $5,500. Just how does my insurance deductible influence the price of my insurance policy? Typically, the lower your insurance deductible, the greater the cost of your insurance will certainly be. The higher your insurance deductible is, the reduced the expense of your insurance will be.

Not known Facts About Full Coverage Vs. Liability Auto Insurance

How do I get vehicle insurance policy? When buying insurance, the Division of Insurance recommends that you seek the advice of a certified insurance policy specialist. There are 3 sorts of experts that typically market insurance policy: Independent representatives: can offer insurance from numerous unaffiliated insurers. Special agents: can only offer insurance coverage from the business or group of companies with which they are affiliated.

No matter what sort of professional you pick to utilize, it is very important to confirm that they are accredited to carry out company in the State of Nevada. You can inspect the permit of an insurance professional or business here. Remember Always confirm that an insurer or agent are accredited prior to providing personal info or https://s3.ap-northeast-1.wasabisys.com payment.

These aspects include, however are not restricted to: Driving record Claims background Where you live Sex and also age Marriage Standing Make as well as version of your automobile Credit Nevada has one of one of the most affordable as well as healthy vehicle insurance markets in the country (cheaper auto insurance). Purchasing insurance policy may enable you to accomplish competitive pricing.

To learn more about making use of your credit history details by insurance provider read our Often Asked Inquiries Regarding Credit-Based Insurance Ratings. insurance company.

Home damage responsibility insurance coverage pays for damage you cause to the property of others. Accident coverage pays for physical damages to your auto as the outcome of your auto clashing with a things.

Examine This Report about What Is Liability Car Insurance? - Policygenius

You and relative detailed on the plan are also covered when driving another person's car with their authorization. It's very important to have enough liability insurance policy, due to the fact that if you are involved in a severe mishap, you may be sued for a large amount of cash. It's advised that insurance holders purchase even more than the state-required minimum responsibility insurance, sufficient to shield possessions such as your house and also cost savings.

At its widest, PIP can cover medical payments, lost earnings and also the expense of replacing solutions usually done by a person hurt in a car crash. affordable auto insurance. It might likewise cover funeral costs. Residential or commercial property damage responsibility This protection spends for damages you (or a person driving the automobile with your approval) might create to another person's home.

It likewise covers damage caused by potholes.

If you're not to blame, your insurance policy company might try to recuperate the quantity they paid you from the various other driver's insurer and, if they achieve success, you'll likewise be repaid for the deductible. Comprehensive This insurance coverage compensates you for loss because of theft or damage triggered by something various other than a collision with an additional car or item.

Searching for automobile insurance coverage? Here's how to find the right policy for you and also your automobile..

The smart Trick of Liability Car Insurance That Nobody is Discussing

Responsibility insurance policy additionally will certainly spend for your lawful defense expenses if you are taken legal action against as a result of your involvement with the mishap. Who requires responsibility insurance coverage? Any person that drives an automobile needs Obligation insurance. In a lot of scenarios, Obligation insurance coverage is called for by regulation. For-hire truckers operating under their very own authority should have Liability insurance policy in order to obtain a declaring.

$30,000 would certainly be the most your insurance would pay for all people harmed in the accident. $10,000 would certainly be one of the most your insurance would pay for all residential or commercial property harmed in a single accident - prices. With a mixed single limit, or CSL, just one number is made use of to describe the limits for both Bodily Injury insurance policy as well as Home Damages insurance coverage.

If you selected a mixed single limit of $1 million, your insurance policy business would pay up to $1 million for all medical as well as injury-related expenses and also all residential or commercial property damage expenses that you caused in a mishap. cheap insurance. Liability insurance coverage instance: You can not stop your van in time, as well as rear-end the vehicle before you.

Several cars If one vehicle on the plan has Liability insurance policy, all of the automobiles must have it. The chosen Responsibility restrictions should be the same for all lorries on a plan. State minimums Each state sets laws concerning exactly how much Obligation insurance its locals are needed to have. This is understood as your state's minimal limits or minimum restriction requirements. cheap.

https://www.youtube.com/embed/ZSRtCMte-Bg

Liability insurance policy is mandated by law in 49 of 50 states, with varying restrictions, and also secures those who have endured loss. Both parts physical injury and also building damages are third-party benefits, one that the chauffeur can not make use of personally. Liability insurance is mandated by law in 49 of 50 states, with varying limits, as well as shields those that have actually suffered loss.

The Ultimate Guide To Drivers Ed (Module 10) Flashcards - Quizlet

Because stats have shown that consumers with reduced credit report are most likely to miss out on a payment, insurance companies might ask you to pay a large percent of the policy up front. Clients with extremely inadequate credit rating might be required to pay the entire 6-or 12-month costs upfront in order for the policy to be provided.

Previous insurance coverage Insurance policy business locate that those without a gap in protection are less likely to obtain right into an accident, so having a continual vehicle insurance coverage background can assist get you a far better price - car. Having a gap in protection even simply a day can result not just in higher car insurance coverage rates, but likewise obtain you penalized by some states. Home owners insurance coverage varies from individual to.

low cost auto cheaper vehicle insurance cheaper car insurance

low cost auto cheaper vehicle insurance cheaper car insurance

person because individual are several personal factors individual variables made use of home compute houseInsurance coverage

Area, The location of your residence affects the amount you pay in premiums - insure. Place is likewise made use of to figure out the replacement costs, given that building and construction expenses, consisting of labor and products, can vary depending on the neighborhood. Both the type of house as well as the quantity of security you desire are driving elements for which house insurance plan to pick.

perks insurance affordable affordable car insurance cars

perks insurance affordable affordable car insurance cars

While it might be tempting to acquire the bare minimum plan due to the fact that of a minimal budget, it will not offer the level of protection you would certainly discover in another sort of plan. You could talk with your insurance provider and agent about optional protections as well as additional plans to aid produce a robust insurance policy package - perks. Regularly asked inquiries, What is the most effective homeowners insurance provider,

Likewise, how countless variables influence your house insurance rates, there are several indicate think about for identifying the very best homeowners insurance business. Should I reduce my protection to decrease my home insurance coverage prices? Lowering the quantity of insurance coverage within your policy is one of the factors that impact home insurance policy prices. While your rates could be reduced, it can likewise restrict the quantity of monetary defense a comprehensive plan offers. A better option is to speak to your accredited insurance coverage agent and also learn if there are other means to trim expenses, such as applying a price cut you currently qualify for (vehicle). If you set up a brand-new roof covering after that it can decrease the costs, given that this is commonly a big expense for an insurance firm to cover. Be sure to talk with your insurance representative about any updates made and also if it could indicate a lower rate. Please briefly explain why you feel this inquiry needs to be reported. Please briefly describe why you feel this solution must be reported. Please briefly discuss why you feel this customer ought to be reported. Auto insurance coverage is one of the most vital facet of getting a new vehicle. Costs are not the same for all chauffeurs as well as for excellent reason. There are lots of elements the auto insurance provider will certainly consider when identifying an ideal vehicle insurance coverage premium.

This message takes an appearance at which of the following affects one's automobile insurance coverage costs and just how this can be used to obtain a much better vehicle insurance coverage quote in South Africa. Wedded couples can even flaunt a discounted insurance coverage price when they incorporate plans. Age A concrete guideline in the insurance industry is "the younger the driverChauffeur the higher greater rates Prices.

auto cars insure automobile

auto cars insure automobile

Automobile Design The insurance provider concerned will gather information on the lorry design that will certainly determine the price of costs. A few of these data collections consist of: Cost of repairs Price of purchase Price of service Theft and also burglaries Accident price Perceptiveness and also safety and security tests Just how Will the Car Be Utilized? This feels like an odd question, yet it's an essential one.

If you intend to guarantee a cars and truck that will certainly be made use of for business factors, it would certainly be best to disclose the details quickly. Cars and trucks implied for company usage have added coverage choices that personal cars don't have. cheapest car insurance. The insurance coverage will be a lot more, but it is because of the fact that they posture a bigger risk to the insurer.

Minimum coverage is typically also minimal to fully help the insuree in case of a mishap. There are plans and great print that need to read prior to selecting the proper protection - insurance. It might be best to go with a fuller insurance coverage choice that will lower the excess amount payable as well as assist thoroughly when the demand occurs.

What Makes Your Car Insurance Go Up Things To Know Before You Buy

Extra gas mileage on the automobile will certainly likewise indicate that added solutions and also repairs might have to be done on the cars and truck This most absolutely raises the monthly costs. Rising cost of living Insurance coverage premiums will undoubtedly increase, no matter other elements. Repairs, services, and also other players in the video game are all vulnerable to inflation and this is something that nobody can get away. suvs.

vehicle insurance vans affordable trucks

vehicle insurance vans affordable trucks

Around 70% of vehicle drivers are uninsured. And with 800 000 crashes on South African roadways yearly, drivers are more likely to be entailed in a crash with an individual that is without insurance.

credit low cost cheaper car cheapest car

credit low cost cheaper car cheapest car

New drivers Guy under the age of 25 Motorists with an auto deemed "unsensible" Vehicle drivers that are taken into consideration older Those whose insurance plan have expired Those that stay in high-risk areas Vehicle drivers of automobiles who are considered to be risky for burglary Motorists with added https://s3.eu-central-1.wasabisys.com/choosing-automobile-insurance-policy/index.html gas mileage Unmarried drivers Those who have reduced credit report Chauffeurs who have actually made lots of insurance claims Vehicle drivers with a negative driving background Elements That Affect Cars And Truck Insurance Control What You Can There are several cars and truck insurance factors that will permanently run out your control, yet there are some that you can organize - business insurance.

Auto Version The insurance firm concerned will certainly gather information on the lorry version that will figure out the cost of premiums. A few of these data collections consist of: Price of repair work Price of acquisition Expense of solution Theft and also break-ins Accident rate Sensibility and also safety examinations Just how Will the Auto Be Utilized? This feels like a strange question, however it's a crucial one.

If you plan to insure a cars and truck that will be used for organization factors, it would certainly be best to disclose the info immediately. Vehicles indicated for business use have added coverage alternatives that individual automobiles do not have. The insurance coverage will be extra, but it is because of the fact that they posture a bigger threat to the insurer.

Little Known Facts About Car Insurance Dubuque - Hub International.

Minimum protection is typically too minimal to totally aid the insuree in the event of a mishap (cars). There are policies as well as fine print that should be checked out before picking the appropriate protection. It may be best to choose a fuller coverage option that will reduce the excess quantity payable as well as help adequately when the demand arises.

Added gas mileage on the automobile will also mean that added solutions as well as repair services might need to be done on the auto This most definitely increases the monthly premium. Inflation Insurance coverage premiums will certainly increase, despite various other variables. Repairs, solutions, and also other gamers in the video game are all at risk to inflation as well as this is something that nobody can run away - cars.

About 70% of chauffeurs are uninsured. And also with 800 000 accidents on South African roads each year, motorists are a lot more most likely to be involved in an accident with an individual that is without insurance.

https://www.youtube.com/embed/I0RjElRT6is

New drivers Guy under the age of 25 Chauffeurs with an auto regarded "unsensible" Vehicle drivers who are considered older Those whose insurance coverage have expired Those who reside in risky areas Vehicle drivers of cars and trucks who are regarded to be risky for theft Chauffeurs with added mileage Unmarried motorists Those that have reduced credit rating Chauffeurs who have actually made lots of insurance coverage declares Drivers with a bad driving history Variables That Affect Auto Insurance Policy Control What You Can There are lots of cars and truck insurance coverage factors that will forever be out of your control, however there are some that you can organize.

How How Does Car Insurance Work? - The Hartford can Save You Time, Stress, and Money.

Do you need insurance policy to rent an auto? As any person that has stood at a cars and truck rental counter has experienced, it is very important to know whether you require insurance to lease a cars and truck. These aren't inquiries to contemplate in the nick of time, with the rental vehicle agent all set to include additional day-to-day fees to the rental.

Obviously, this all relies on the insurance coverages the policyholder selected for the personal auto policy. What might not be covered by this insurance policy is the rental automobile firm's loss of use and income it declares while the damaged auto is being fixed, or a loss in that cars and truck's value (auto).

Specifically when traveling abroad, tenants should specifically ask their insurance representatives concerning any available insurance coverage. For even more questions, call your agent With every one of these kinds of prospective damages and coverages, it's handy for policyholders to call their insurance coverage agents to confirm precisely what their plans cover and what problems set off car insurance coverage.

Even within a single firm, policyholder choices influence their specific insurance coverage. Ask an agent what added protections are offered. It's frequently much cheaper to add protection than the majority of consumers understand and also gradually the saving can be significant.

, yet the kind and also cost of that coverage can differ considerably. Each day, consumers are finding that there are choices readily available to make it less complicated to adhere to the legislation - insurance. The Vehicle Insurance Policy Cost Decrease Act mandated that a be readily available to all drivers. It is crucial to recognize that you are breaking the regulation if you drive uninsured.

What Does What Does Rental Car Insurance Cover? Do?

In the future, your vehicle might be impounded if you are caught behind the wheel without coverage. Below we will evaluate the. The Standard Plan provides less protection, yet at a lower expense than the - insurance companies.

Under this coverage, your insurance company supplies you and all loved ones that stay in your house with defense against financial losses arising from injuries received in automobile accidents anywhere within the United States, its regions and also possessions, or Canada (vehicle). It also supplies insurance coverage for any travelers hurt in mishaps in New York State while in your lorry, as well as any guest travelers who are New york city State citizens hurt in your lorry anywhere in the United States, its territories and also possessions, or Canada, if they are not covered under another vehicle insurance plan in New York State.

deliberately causing his or her very own injuries; riding an all surface automobile (ATV) or a bike as operator or guest (a pedestrian struck by a motorcycle or ATV is covered); hurt while dedicating a felony; harmed while in a car recognized to be stolen; or an owner of an uninsured car. low cost.

When buying for insurance policy, please talk to your insurance policy business, representative or broker regarding whether your policy manages physical injury obligation coverage to your spouse - affordable. Without Insurance Vehicle drivers Insurance coverage An additional important function of your automobile insurance plan is bodily injury defense for you, all relative who live in your home, as well as residents of your vehicle, in case you or they are hurt as the result of negligent activities by a without insurance car or hit-and-run vehicle driver.

The New York City Division of Motor Autos (DMV) has a system, called the Insurance coverage Info and also Enforcement System (IIES), that discovers uninsured vehicles (vehicle). Insurers are called for to report to the DMV information, such as terminations, renewals, and issuance of brand-new plans, on all persons they insure for car insurance policy.

See This Report on Auto Insurance Guides – Resources - Plymouth Rock

Failure to keep liability insurance policy coverage for your vehicle in any way times can cause the suspension of your automobile registration as well as driver's permit, in addition to other significant financial charges. These procedures could lead to you obtaining a letter from the DMV asking about your insurance coverage condition even if your automobile is currently guaranteed.

/car-scratches-and-car-insurance-527084_final-01-a9a5aa68fa3a4a7b9bc24a5fc6cb5319.png) what does car insurance cover

what does car insurance cover

Contact your insurance representative, broker or business for assistance in reacting to these letters, or speak to the DMV directly for information on just how to handle such communication. Cars and truck rental arrangements differ from one automobile rental company to an additional. However, all automobile rental business need to give the minimal coverages required by regulation.

/auto-and-car-insurance-policy-with-keys-1048031806-6dbe3526b6d84e14aa23d07fbe11c40e.jpg) what does car insurance cover

what does car insurance cover

For services of 30 consecutive days or less, vehicle rental firms in New York State can offer CDW, or, otherwise bought, charge a renter for the complete worth of a swiped (shed) or harmed rental automobile. The day-to-day expense of the CDW may be as high as $12, depending upon the worth of the car - cheapest auto insurance.

Presently such insurance coverage is currently offered without any kind of extra cost. car insurance. Numerous credit history card business likewise give some form of "crash damages insurance coverage" to their cardholders for lorries they lease with that card. This is separate from any other protection and generally covers losses only in excess of amounts collectible under various other existing coverages.

That usually includes cars and truck crash injuries, car damage, the expense of a rental auto, and also various other out-of-pocket losses. The information of what's covered depend on a number of variables, consisting of where you live and what you have actually chosen under your plan.

7 Simple Techniques For What Is Covered By A Basic Auto Insurance Policy? - Iii

Responsibility Vehicle Insurance Policy Obligation (or fault-based) automobile insurance policy protection uses when someone is harmed in a mishap you trigger; it won't pay your clinical bills after an accident.

Find out much more about how no-fault automobile insurance coverage works. Offered Insurance Coverage and Policy Limits From a lawful standpoint, whoever causes a cars and truck mishap should birth financial responsibility for all resulting damage. But virtually talking, whether (as well as just how much) settlement you can recover after an automobile crash normally depends on: if there's a vehicle insurance coverage that covers your accident-related losses, and also the protection limit on the policy.

You might even win your instance, however accumulating any type of judgment is another issue. Unless the motorist has substantial individual possessions, you could not see much of any type of financial recovery. The same chooses serious cars and truck accidents that create considerable injuries, as well as an at-fault chauffeur that brings only the minimum called for obligation insurance.

That driver's insurance business is only obliged to pay you $15,000 (the policy restriction). The driver gets on the lawful hook for the remaining $5,000 (and also any type of extra payment you're most likely qualified to for your pain and suffering), yet suing them might not deserve the moment and also effort if you can not collect on any judgment.

what does car insurance cover

what does car insurance cover

Allow's consider a couple of alternatives. money. Without Insurance Driver (UIM) Protection Uninsured motorist insurance coverage enters into play when the at-fault motorist has no auto insurance policy. Here, you would file an insurance claim with your very own insurance company for UIM advantages, which ought to pay for your clinical expenses and also other losses, also "pain and also suffering," approximately your UIM insurance coverage limitations.

The Greatest Guide To Car Insurance Faqs : Auto Insurance : State Of Oregon

In a lot of states where it's thought about add-on protection, insurance companies are called for to provide it to clients, but consumers are complimentary to decrease it. Keep in mind that most UIM polices don't cover car damages; you'll normally need to add separate "without insurance driver property damage insurance coverage" if you desire your automobile covered (risks).

However note that you can generally only make an underinsured vehicle driver case with your insurance provider if your underinsured chauffeur protection exceeds the at-fault motorist's policy restrictions. Let's utilize an instance to illustrate this. Say your instance is worth $30,000, but the motorist that strike you just has $20,000 in liability protection - auto insurance.

If you had $50,000 in underinsured vehicle driver protection, you would certainly settle with the negligent motorist for $20,000, as well as after that you would certainly try to resolve with your insurer for an additional $30,000.

A lot of collisions will certainly likewise result in some measure of vehicle damages, so it is essential to keep a few things in mind: automobile damages cases aren't generally covered by no-fault vehicle insurance policy, also in "mandatory no-fault" states in every state, the at-fault vehicle driver's home damage responsibility insurance coverage can be used to cover damages to your lorry additionally in every state, your very own collision insurance coverage can be used to get your automobile repaired or replaced after an accident, no matter of that was at mistake for the crash.

And for lawful recommendations that's customized to your scenario, it may make sense to review your choices with an attorney. insure. Find out more concerning just how an attorney can assist with a cars and truck accident instance.

Unknown Facts About Car Insurance Coverage Types - Root Insurance

Contrast quotes from the top insurance policy companies. What Is Liability Vehicle Insurance Policy and What Does It Cover?

what does car insurance cover

what does car insurance cover

If you are hit by someone else, and also it's their fault, their liability insurance will cover damage to your auto and your clinical expenses. There are 2 sorts of obligation insurance policy: Bodily Injury Obligation, Bodily injury obligation covers the motorist and also occupants of the various other car if you trigger an at-fault accident causing injuries. dui.

Physical injury obligation covers medical expenses, pain as well as suffering and earnings lost by the various other person as a result of not having the ability to function while recuperating from injuries. Home Damage Obligation, Home damage obligation insurance coverage covers damage to the various other person's residential property, typically their automobile, but it can include products inside the vehicle. cheap car.

The last 50 describes the amount of building damage liability per mishap, which would also be $50,000. Remember that physical injury liability is each, while property damage obligation is per accident. If you struck three individuals and three vehicles in the same accident, your insurance will certainly cover you for approximately $100,000 for the bodily injuries of individuals you hit ($100,000 maximum) as well as just as much as $50,000 for all 3 of the vehicles.

If you add collision and extensive insurance policy to your policy, you as well as your lorry will be covered in a mishap if you're at mistake. This makes the additional cost of the insurance coverage worth website it to a lot of people - vehicle insurance. Collision will certainly cover damages that occurs from striking something, as well as detailed covers damages from burglary, weather, animals (such as hitting a deer) and also vandalism.

The Main Principles Of Car Insurance Coverage - Amica

https://www.youtube.com/embed/Jt3olmyzaksSome states additionally call for uninsured vehicle driver protection (UM), underinsured vehicle driver protection (UIM) and injury security (PIP). No matter your state's demands, you require to have responsibility insurance coverage or very deep pockets, as it protests the legislation in the majority of states to drive without liability insurance coverage. New Hampshire doesn't require liability insurance coverage, yet they do need motorists to show they have some methods of financial obligation if they create a crash - car insurance.

What Does Is Pay-per-mile Car Insurance Right For You? - The News Wheel Mean?

Edit your About page from the Pages tab by clicking the edit button.

The Ultimate Guide To Pay-per-mile Car Insurance - How It Works & The Best Rates!

Edit your About page from the Pages tab by clicking the edit button.

Some Known Questions About Pay-per-mile Car Insurance - Lewis Insurance And Financial.

Edit your About page from the Pages tab by clicking the edit button.

Pay-per-mile Auto Insurance: What You Should Know Things To Know Before You Buy

Edit your About page from the Pages tab by clicking the edit button.

Not known Details About How To Get Cheap Auto Insurance For Low-mileage Drivers

Edit your About page from the Pages tab by clicking the edit button.

The Definitive Guide for Metromile: Pay Per Mile Car Insurance

Edit your About page from the Pages tab by clicking the edit button.

The smart Trick of Gap Insurance - Wikipedia That Nobody is Talking About

Edit your About page from the Pages tab by clicking the edit button.

5 Easy Facts About Do You Need Gap Insurance For Your Car? How Does It Work? Shown

Edit your About page from the Pages tab by clicking the edit button.

Some Known Facts About What Is Gap Insurance? - Capital One Auto Navigator.

Edit your About page from the Pages tab by clicking the edit button.

Getting The Total Loss Protection (Gap) - Hertz Car Sales To Work

Edit your About page from the Pages tab by clicking the edit button.

Rumored Buzz on What Is Gap Insurance? - The Zebra

Edit your About page from the Pages tab by clicking the edit button.

The Facts About Gap Insurance For Your New Or Leased Cars Revealed

Edit your About page from the Pages tab by clicking the edit button.

The Best Guide To Car Insurance Cost Estimator: Low Rates & Payments (2022)

Having the right details in hand can make it much easier to obtain a precise cars and truck insurance coverage quote. You'll want to have: Your chauffeur's license number Your car identification number (VIN) The physical address where your automobile will be stored You may likewise wish to do a little study on the kinds of protections readily available to you.

vehicle low cost low-cost auto insurance car insured

vehicle low cost low-cost auto insurance car insured

How can you save cash on automobile insurance policy? Inexpensive car insurance coverage rates can be difficult to discover if you have a dangerous vehicle driver account or stay in a state with greater protection requirements - car. Chauffeurs ought to think about completing the adhering to actions to receive the most affordable insurance coverage premium feasible: The distinction in between the most affordable and most expensive insurance provider can range in the hundreds of dollars each year.

car affordable cheaper car vehicle insurance

car affordable cheaper car vehicle insurance

Responsibility insurance coverage economically reimburses various other vehicle drivers who have actually been associated with an accident where you are at mistake. Obligation insurance coverage is needed in the Area of Columbia and also every state other than New Hampshire. vehicle insurance. A lot more protection will certainly result in a greater expense annually; nevertheless, state minimums commonly aren't high sufficient to cover the ordinary insurance claim.

Collision protection pays for damages to your cars and truck after an accident with another auto or a fixed object, no matter that's liable. Vehicle drivers with rented or financed lorries will certainly probably be required to buy this protection. The ordinary chauffeur must take into consideration these protections if their car is brand-new or worth even more than $2,000 - cheap car.

Over 20 states require drivers to have some form of uninsured/underinsured driver coverage. Also if your state does not need it, you should still take into consideration buying it it's affordable, and also 1 in 8 chauffeurs do not have insurance policy. We advise limitations for these coverages comparable to the limitations on your bodily injury as well as residential property damages coverage.

How Much Umbrella Insurance Do I Need? - Kiplinger Can Be Fun For Everyone

car auto insurance cheap car insurance suvs

car auto insurance cheap car insurance suvs

Regularly asked inquiries Just how a lot will my cars and truck insurance coverage price? The ordinary cost of minimal insurance coverage car insurance in the USA is $785 per year, or $65 monthly (vehicle insurance). Nonetheless, your prices will certainly differ based upon where you live, what sort of cars and truck you have as well as your driving history.

The typical rate of auto insurance nationwide is $785 per year for a minimal insurance coverage policy (cheap car insurance). What kind of automobile insurance should I obtain?

Picking the most effective car insurance protection, Getting the right degree of auto insurance policy is not one size fits all. What is most crucial to one vehicle owner isn't needed for an additional. That's why it's critical to obtain a bird's eye sight of the various kinds of automobile insurance as well as the auto insurance policy that fits your details's Automobile Insurance coverage Calculator is a fast means to locate the appropriate auto insurance policy degrees and choices for you.

And also do not worry if you want to recognize what the cheapest prices as well as best security insurance coverages would be, we let you toggle between the results for both. Just how much vehicle insurance coverage do I require? It will also pay for problems you created to somebody else's property, for instance if your amateur teen driver strikes your next-door neighbor's fence.

Rumored Buzz on Car Insurance Calculator - Comparethemarket.com - Compare ...

Comprehensive covers your lorry for "apart from accident" occasions like theft, fire as well as damages from weather events like flooding and also hail. Collision covers, no matter fault, if your cars and truck is damaged in a car mishap or if you roll or flip your automobile by crash. auto insurance. Comp and also crash are not needed by any state yet is financing companies if your vehicle has a lease or funding on it.

It covers the "void" left when your insurance coverage payment is not enough to cover the payback on your auto - low-cost auto insurance. Spending for this added insurance coverage is better than continuing paying on an auto that you no longer cars and truck drive. If you register for gap insurance coverage, your insurance company will identify just how undersea you are with your vehicle worth and establish just how much the plan would certainly pay out (credit).

Exactly how to estimate car insurance coverage prior to buying a vehicle, When you're in the search for a new cars and truck( whether it's a brand

new car brand-new just new to brand-new), it is essential to important around go shopping about insurance automobile at prices same time. You do not desire to find the ideal vehicle just to find out you can Click here! afford the automobile payments however not the expense to insure it (car). Automobile insurance policy companies weigh several numerous variables considering taking into consideration rate to charge bill, including your age, driving record, address, the type of car vehicle drive and and alsoExtra

A Biased View of Car Insurance Calculator - Save Money With Auto Insurance!

Chauffeurs with tidy driving records not only obtain much better rates, but they additionally may be eligible for other discounts (trucks).: Paying your expenses on time can suggest lower auto insurance policy rates in states that permit companies to use credit scores background when determining premiums.: The more your vehicle is worth, the much more you'll pay for auto insurance coverage. What are the ideal vehicle insurance business? In Ontario as well as past, car insurance policy carriers make use of complex algorithms based on a wide variety of factors to identify each vehicle driver's special insurance coverage price.

How To Reduce Your Auto Insurance Expense, Compare quotes as well as save on typical$ 961/year on car insurance. The price of your car insurance policy is calculated by insurance policy companies evaluating the degree of danger you present to them. You'll also find that those who have a clean driving document, with no previous crashes and a lengthy no claims incentive, will normally get less costly automobile insurance.

The 8-Minute Rule for Usaa Tops List Of America's Best Auto Insurance Companies

Credit, Driving background, Where you live, The sort of car your drive, The number of miles you drive, Your driving experience, Gender, Age, Own a home, Current claim fads, Geographical fads like regulations or weather condition in a location: Insurance provider have located a relationship in between debt ratings and also the threat of an insurance claim for all major insurance types. liability.

cheaper auto insurance credit score cheaper auto insurance low-cost auto insurance

cheaper auto insurance credit score cheaper auto insurance low-cost auto insurance

insurance affordable cheapest auto insurance auto insurance cheaper cars

insurance affordable cheapest auto insurance auto insurance cheaper cars

It's common for insurers to weigh crashes in the previous 5 years and tickets or infractions in the past 3 years. Where you live is a larger offer than you might think. Urban locations have extra cars and trucks on the roadways to encounter as well as a lot more disturbances. The repair work or replacement expenses might be greater with specific makes or versions.

The security attributes or accident rankings of a certain kind of vehicle affect rates.: Every mile driven is a mile in which you might be entailed in a crash. insurance. Some insurers use a discount for low mileage chauffeurs. If your mileage usage is well over the average of about 15,000 miles each year, some insurance firms will certainly bill more.

Some insurers won't also write a plan for a driver with less than 3 to 5 years of driving experience. Typically, men will certainly pay greater than ladies, specifically if they're more youthful. More youthful chauffeurs will certainly pay even more than older motorists. Different insurance firms start to offer cost breaks at various ages.

The Definitive Guide for Best Car Insurance Companies In California - Cars.com

Others begin at age 25, or perhaps 30. Some insurers will also charge a lot more for drivers over the age of 70. low-cost auto insurance. Insurer normally offer reduced rates to home owners since they have actually found a correlation between homeownership and also lowered threat. You can additionally bundle your homeowner's insurance.: It's not uncommon for an insurance company to raise prices in a state following an event that creates a rise in insurance claims, like a big storm.

In various other instances, an area can be more pricey due to the fact that the roads are much more greatly congested. Weather condition occasions can likewise be one more driving force that impacts prices by region. Hailstorm, wind, as well as storms can create damage to automobiles, cause mishaps, and also produce surges in cases. What is Not Covered by Auto Insurance Coverage? Also the most effective cars and truck insurance plan will not cover everything (vehicle insurance).

You want to get in touch with your insurance coverage representative or carrier - cheap car insurance. Additionally, if the rental car is damaged, you will certainly not be covered for "loss of use" when the rental company can't lease the auto to somebody else since it is being repaired, or for "decrease", which is the loss of value for the rental automobile even after it is repaired.

With some insurance business, they have the ability to add an additional recommendation to the automobile policy to cover rideshare. Contact your insurance policy agent or carrier to see if this is an option. Individual home (laptops, phones, and so on) harmed in a mishap or taken from your auto may be by your auto insurance plan.

The Best Strategy To Use For Best Car Insurance Companies - Auto Express

You intend to contact your insurance provider. If you have a homeowners or renters insurance policy, you may have the ability to place an insurance claim with that said plan, based on your insurance deductible. f you set fire to your auto, the insurance coverage company will not pay to fix or change your auto.

These points may seem far-fetched, as well as you're a lot more likely to have an usual fender-bender, yet your insurance coverage most likely leaves out all of these risks if any of them do occur. What is Car Insurance coverage? Like most insurance policy policies, a car insurance protection plan is a legal arrangement between you as well as the insurance firm - insurers.

cheaper car insurance perks credit score insurers

cheaper car insurance perks credit score insurers

Car insurance coverage usually provides 3 kinds of coverage, or defense, with different states having various minimum insurance coverage mandates. BZ 3 Kinds Of Security in an Automobile Insurance Coverage: this covers occasions like theft or damages to your car in an accident - auto insurance.: this gives monetary protection for your or others clinical expenses must any kind of result from an accident or occasion while driving your automobile.

If you live in a state that makes use of Personal Injury Defense to provide clinical insurance coverage on your automobile insurance plan, you'll have options of coverage as low as $15,000 in some states. A reduced quantity of. An agent or manufacturer may likewise recommend a greater insurance deductible for your PIP, additionally to keep costs down.

The 5-Second Trick For J.d. Power Names Best Car Insurance Companies In The U.s. ...

You might have to pay one more deductible and co-pay. Also if your deductible is just $500 with no co-pay, you're still paying $3,500 out-of-pocket at this factor. cheapest car insurance. As you can see, the savings offered with reduced protection limits and greater deductibles might be alluring, yet likewise might not be worth the monetary danger depending upon your individual economic situation.

Vehicle Insurance policy Estimates Lots of firms deal with insurance coverage as a commodity, commonly offered and with little difference in functions or options. Amica as well as our Unique Mention choice, USAA, both acknowledge that clients are acquiring solution, not just insurance coverage.

Packing your items is an additional way to lower your vehicle insurance costs. addressed 2022-05-09 Benzinga Just how do I guarantee that I'm appropriately covered for car insurance coverage? 1 How do I make certain that I'm correctly covered for vehicle insurance? asked 2022-05-09 Eric Huffman 1 The very best point you can do is speak with your insurance service provider or agent as well as be sincere concerning your cars and truck as well as driving history.

cheap car insurance affordable money suvs

cheap car insurance affordable money suvs

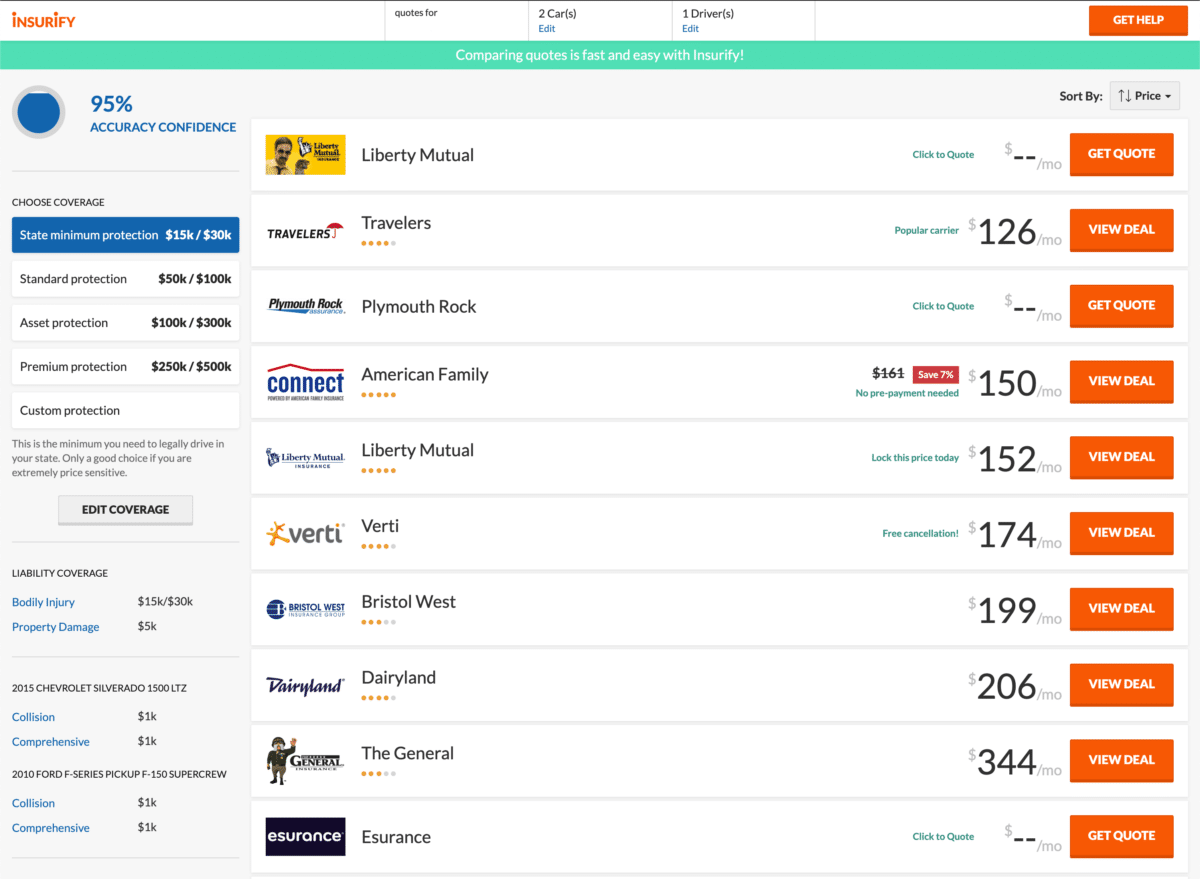

That's why it is necessary to do your research study and contrast your choices when picking the most effective automobile insurance provider for your needs. Once you have a concept of what your costs may be from a few various companies, after that you can take a look at aspects that set certain vehicle insurer in addition to others, like auto insurance coverage add-ons or customer complete satisfaction rankings. affordable auto insurance.

The State Auto Insurance Statements

Availability, automobile claims contentment, price, and the firm's monetary health and wellness are all crucial aspects we consider in our referrals. While no single automobile insurance policy company will certainly be the very best for every individual, we assume these are the ones to think about when on the market for cars and truck insurance coverage. To establish our choices for the very best cars and truck insurance provider, we began with a list of 25 of the biggest automobile insurance provider by premiums gathered, based upon data from the National Association of Insurance Commissioners.

We eliminated any kind of business that does not have A.M. Ideal's rating of A+ or greater. We additionally eliminated any type of business that are included in any type of energetic scams examinations. Our Picks for the Finest Auto Insurer Business Overview, GEICO GEICO, the second-largest auto insurance provider in the nation, insures almost 30 million automobiles, according to its site - low cost auto.

Car Insurance Claims Contentment Study. It additionally has the cheapest ordinary annual costs of insurance companies on this list. This budget-friendly business does not supply one of the most special discount rates, however it provides many common price cuts for consumers like savings for bundling plans or for having even more than one auto on the policy.

The average costs gets on the higher end of the range, yet there are lots of discount rates to offset your cars and truck insurance coverage premiums. For instance, you can get a price cut on your costs if you have a crossbreed or electrical vehicle or guarantee multiple vehicles with Tourists.$1,325: For motorists looking for a vehicle insurer with solid customer support, Travelers can supply - car.

About Usaa: Insurance, Banking, Investments & Retirement

On the J.D. Power 2018 United State Auto Insurance Claims Complete Satisfaction Study, Travelers scored slightly listed below the market standard, but was still in advance of some major companies like Progressive as well as AAA. Testimonials for Tourists indicate that clients are consistently pleased with its customer support, several discount rate alternatives, and insurance coverage packages. Travelers Protection Kind Available, Responsibility insurance coverage, Comprehensive and collision coverage, Injury protection and medical repayments, Uninsured as well as underinsured vehicle driver protection, Gap insurance coverage, Rental coverage, Roadside help, New car replacement, Crash mercy, Rideshare insurance coverage, Travelers Discounts, Safe vehicle driver discount rate, Homeownership price cut, Multi-vehicle and also multi-policy price cuts, Hybrid/electric car price cut, Trainee discounts, Driver training price cut, Mileage-based discount rate, Very early quote discount, New car discount, Client loyalty discount, Discounts for just how you pay (going paperless, vehicle pay, and also paying completely)State FarmState Farm is the biggest auto insurer in the U.S., providing all the usual cars and truck insurance coverage coverages, plus a few practical add-ons like rideshare insurance, gap insurance, and also pet injury security. As of 2019, it has 44 million active car plans in the united state $1,457 State Ranch attracts attention as an insurance provider for its fair costs, access, and car claims fulfillment. State Farm's typical annual premium rate is a little greater than other prices on this listing, yet still fairly low contrasted to the remainder of the sector.

It ranks high in affordability, customer contentment, and also its breadth of coverage alternatives. It just supplies insurance policy to army participants, professionals, as well as their family members, making it an excellent one-stop shop for those in that group but not the remainder of the United state

auto car insurance vehicle insurance cheaper car

auto car insurance vehicle insurance cheaper car

$1,225 USAA Coverage Types Available, Obligation protection, Crash and detailed protection, Uninsured and also underinsured motorist insurance coverage, Personal injury security and also medical payments, Roadside assistance, Rental auto compensation, USAA Discounts, Safe motorist discount rate, Trainee discount rate, New lorry discount rate, Driving training price cut, Multi-vehicle and also multi-policy discounts, Base as well as storage space discount, Mileage-based discount rate, Customer commitment price cut Defensive driving discount, Erie Insurance Erie Insurance does not supply insurance coverage across the Additional info country, however if you're looking for a budget friendly costs as well as live in one of the few states it's offered in, it is noteworthy for its reduced prices (liability).

Our Best Car Insurance For Young Adults - Money Under 30 PDFs

Although it's limited to these states, its average yearly costs is one of the most affordable of this checklist. Erie sells insurance solely with its network of independent agents as well as none of its insurance policy offerings can be bought from the company straight - low cost auto. Erie has one of the greatest cases complete satisfaction ratings, according to J.D.

It's ideal for vehicle drivers that value an one-on-one relationship with an agent and aren't concerned about extra functions, such as an app or distinct coverage add-ons. Auto-Owners has the third highest possible cases satisfaction rankings, according to J.D. Power. And also, its auto insurance coverage rates are fairly reduced contrasted to other popular insurance providers.

Often Asked Concerns What is the ideal car insurer? There is no one-size-fits-all service when it pertains to vehicle insurance. A particular cars and truck insurance firm may be the most effective for someone and not the most effective for an additional individual. A great deal of the decision boils down to how much insurance coverage you require on your own and your automobile, as well as how much protection you can affordand which insurer best meets your demands.

What's the distinction in between buying from an independent insurance representative or a restricted insurance policy representative? Can you acquire car insurance policy without an agent? There are a few means you can buy vehicle insurance. You can buy it online without a representative's help, yet it does require more research in terms of understanding and also comparing plans.

Best Car Insurance Companies Of 2022 - Consumeraffairs Can Be Fun For Anyone

Independent representatives benefit themselves and aren't connected to a particular insurance coverage firm, so they're able to be much more objective and can advise policies from a range of cars and truck insurance provider. They can in some cases be a little costlier since their revenue comes from their sales. Captive representatives are the complete reverse; they help a solitary insurance provider as well as only supply their business's insurance policy products.

Comprehensive automobile insurance pays to fix your car if it endures non-collision damage triggered by falling items, fire, criminal damage, climate events, or a collision with a wild pet. It also aids pay for automobile theft.

5 Insure. Drivers can acquire protection online, over the phone or by means of a local agent. Dynamic deals a suite of price tools ("Call Your Cost") that permit customers to save money on their plan while including the coverages they need to their policies.

com Ranking The Car Club Group, or the Automobile Group, is another AAA club that offers cars and truck insurance as well as other services such as banking and also travel. The Vehicle Group is just one of the largest of AAA's 25 clubs. It offers automobile insurance policy in 14 states in addition to Puerto Rico.

The Ultimate Guide To Best Car Insurance Companies Of May 2022 - Time

It likewise provides really solid insurance coverage for classic vehicles. Allstate has a benefit program that enables customers to make points that can be redeemed on day-to-day offers, gift cards and even take a trip. 0 Insure.

com Rating Farmers markets auto insurance policy and various other insurance coverage products in all 50 states via special as well as independent representatives. Farmers supplies a variety of insurance coverages as well as is delighted to guarantee most car kinds consisting of recreational lorries, boats, jet skis, snow mobiles, bikes, ATVs, golf carts and recreational vehicle. Farmers offers an alternative fuel discount rate for automobiles that are powered by anything apart from gasoline-only: hybrid, electric, gas, lp.

https://www.youtube.com/embed/L_Ys96lUtIs

com Ranking Much like the Automobile Club of Southern The Golden State, CSAA is associated with the AAA group. While the CSAA initially started in the Northern The Golden State, Nevada and Utah location, it has actually given that become one of the most significant AAA teams. CSAA markets insurance policy in 23 states as well as the Area of Columbia - insurers.

3 Simple Techniques For What Is The Average Cost Of Auto Insurance? - Moneygeek

Having the appropriate info in hand can make it easier to get a precise auto insurance coverage quote (insurers). You'll want to have: Your vehicle driver's license number Your vehicle identification number (VIN) The physical address where your lorry will certainly be stored You may likewise intend to do a little research study on the kinds of coverages readily available to you.

Noted listed below are other things you can do to reduce your insurance policy prices. Store around Prices differ from business to company, so it pays to shop around. Your state insurance coverage division might likewise offer comparisons of costs billed by major insurance firms.

It is essential to pick a firm that is solvent. Inspect the financial health and wellness of insurer with rating business such as AM Finest () and Criterion & Poor's (www. standardandpoors. liability.com/ratings) and also get in touch with consumer publications. Get quotes from various kinds of insurer. Some offer with their own agents. These companies have the exact same name as the insurance coverage firm.

Don't shop by rate alone. Call your state insurance division to discover out whether they offer details on consumer issues by firm. Choose an agent or company agent that takes the time to address your concerns.

The 8-Minute Rule for What's The Average Cost Of Car Insurance In 2020? - Business ...

Before you acquire a cars and truck, compare insurance coverage prices Prior to you purchase a new or used auto, check right into insurance policy costs. Auto insurance policy premiums are based in component on the car's rate, the cost to repair it, its overall safety and security document and also the chance of burglary.

Evaluation your insurance coverage at revival time to ensure your insurance demands haven't transformed (laws). 5. Acquire your home owners and also automobile insurance coverage from the same insurance firm Many insurance companies will certainly provide you a break if you get two or even more kinds of insurance policy. You may additionally obtain a reduction if you have greater than one automobile insured with the very same company.

Ask concerning team insurance policy Some companies provide reductions to vehicle drivers that obtain insurance coverage with a group plan from their employers, through expert, organization and also alumni groups or from other organizations. Ask your employer as well as inquire with teams or clubs you belong to to see if this is possible.

Seek out various other price cuts Firms supply discount rates to policyholders who have actually not had any mishaps or moving offenses for a number of years. cheapest. You might likewise get a discount rate if you take a defensive driving program. If there is a young driver on the policy who is a good trainee, has taken a chauffeurs education program or is away at college without a cars and truck, you might additionally get a reduced price.

The Best Guide To How Much Is Car Insurance? - Liberty Mutual

cheap car vehicle insured car accident

cheap car vehicle insured car accident

The vital to savings is not the discounts, but the last price. A firm that uses couple of discount rates might still have a lower total price. Federal Resident Details Facility National Consumers Organization Cooperative State Research, Education And Learning, as well as Expansion Service, USDA. cheap auto insurance.

insurance companies insurance insurance car insured

insurance companies insurance insurance car insured

insure cheapest car insurance affordable car insurance

insure cheapest car insurance affordable car insurance

Normally vehicle insurance companies will certainly bill a lot more for younger motorists and provide affordable prices for older chauffeurs. Insurance coverage carriers see young drivers as unskilled as well as have a higher risk of entering crash. In Texas, the normal teenager vehicle driver in between the age of 16 and also 19 will pay $279. 82 per month while a chauffeur in their 40s will pay an average of $133.

38 More commonly than not, vehicle drivers who presently have cars and truck insurance policy protection will get a less expensive monthly rate than drivers who do not. Given that auto insurance is a requirement in all 50 states, firms might doubt https://s3.us-west-1.wasabisys.com/factual-statements-insurance-grace-period-used-car/index.html why you do not currently have coverage.